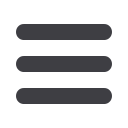

Project economics

SAGE has prepared detailed cost estimates for the onshore

facilities and offshore pipeline. The estimated project cost

is approximately US$4.5 billion, based on the cost update

performed in 2017. The breakdown of the expenditure in terms

of cost area and cost components is provided in Figure 1.

Project history

Over the last three decades, two offshore gas supply projects

have considered the deepwater route across the Arabian Sea to

the Gujarat coast of India. The first was proposed by the Oman

to India pipeline (OIP) project in the mid 1990s, bringing gas

from the Arabian Sea coast of Oman. The second was proposed

in 2003 by the India state gas company GAIL and the Iranian

National Oil Company (NIOC) in a joint venture, bringing gas

from the Arabian Sea coast of Iran. The OIP project highlighted

several technical challenges:

)

Pipe mill capability to manufacture very thick wall linepipe.

)

Pipelay vessel tension capability for installing pipelines in

3500 m water depth.

)

Availability of deepwater pipeline repair systems.

)

Understanding of geohazard issues and potential mitigation.

)

Concerns about flooding, hydrotesting, and drying the

pipeline.

The technical issues were not considered to be hindrances,

however, the OIP project did not go ahead because Omani

sourced gas was reassigned to the Qalhat LNG project.

Encouraged by developments in pipe mill capabilities and

installation vessel improvements, in 2006 SAGE decide to

restart the idea of a gas pipeline joining Oman to India, and

commissioned the first engineering studies to look at initial

feasibility of a pipeline from the Middle East. In 2010, SAGE

employed Peritus International as the project management

consultants for the project. Between 2010 and 2013, numerous

formal feasibility and definition studies and cost estimates

were undertaken for the offshore pipeline and onshore

facilities studies. Technical viability was confirmed by Peritus

International in 2013.

Due to the positive results of these feasibility studies,

SAGE decided to move the project forward by undertaking a

reconnaissance marine survey (RMS).

Studies since 2016 have concentrated on updating previous

work, agreeing the qualification plan to be taken forward

into FEED, and continuing with a pipe mill pre-qualification

programme for non-Indian pipe mills:

•

Flow assurance update – Peritus International (2016).

•

Mechanical design update – Peritus International (2016).

•

Updated cost estimate and schedule – Peritus

International (2016).

•

Chinese pipe mill qualification – PCK (2016).

•

Technical review workshop – SAGE/Peritus/IntecSEA/

EIL/DNVGL/Saipem/Allseas (2016).

•

Technical feasibility confirmation – DNVGL (2017).

Figure 1.

MEIDP cost components and cost areas (2017 cost

update).

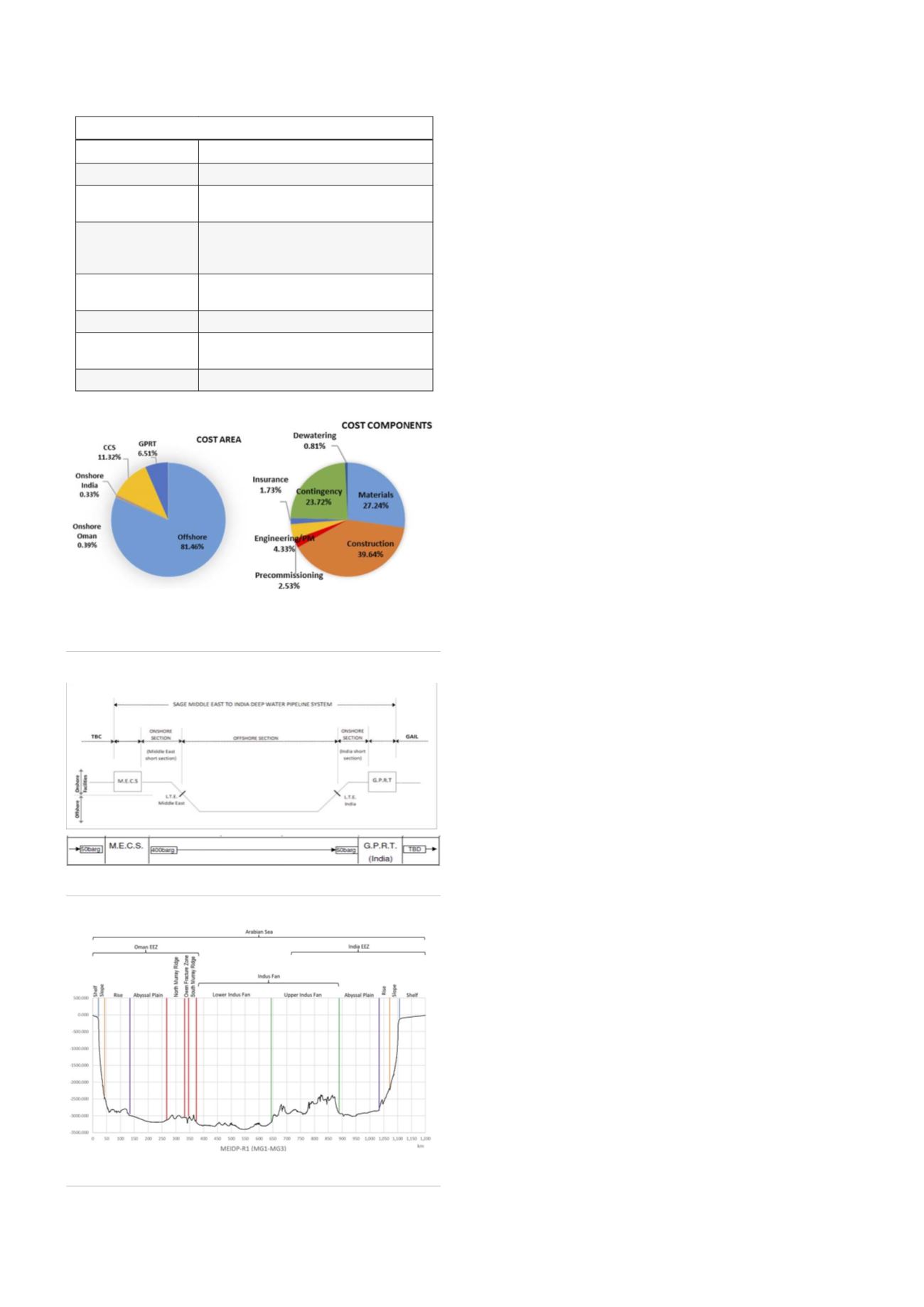

Figure 2.

MEIDP battery limits.

Figure 3.

MEIDP base case route profile.

Table 1.

Identified risks along the pipeline route

Geohazard

Location

Tsunami

Oman and Indian coastline

Steep slopes

Oman and Indian continental slopes and the

Qalhat Seamount

Seismic activity

Northern Oman, Kathiawar Peninsula

(Gujarat, India) and along the Owen Fracture

Zone

Fault displacements Faults of the Owen Fracture Zone and the

Indian shelf and slope

Liquefaction

Oman and Indian (inner) shelf

Slope failures

Oman and Indian continental slope, Qualhat

Seamount, channels of the Indus Fan

Turbidity currents

Indus Fan

24

World Pipelines

/

MARCH 2020