and long distance pipelines that have been built or are still

under construction.

Although some countries aim to reduce the use of fossil

fuels, such as natural gas, global energy and gas demand

is still increasing. Consumption of natural gas globally

is projected to increase from 120 trillion ft

3

in 2012 to

203 trillion ft

3

in 2040 in the International Energy Outlook

2016 (IEO2016) reference case. By energy source, natural

gas accounts for the largest increase in world primary

energy consumption. This also means that so far there is

no foreseeable end to the construction of pipelines for

transporting natural gas, and on a global scale the number

of kilometres of pipeline under construction is only

increasing, though mainly for fewer projects but of larger

scale.

These large-scale projects are of great value for all

parties involved, but in many cases, the sheer size of the

tendered lots exceed the capabilities of single construction

companies, not only in terms of the workforce but also

in construction machinery. This is where many pipeline

construction companies find themselves between a

rock and a hard place: where on one side construction

companies want to own all the necessary equipment

in order to have maximum flexibility, and on the other,

many of them do not want to have the burden of a large

equipment fleet on their balance sheet. In many companies

this results in a discussion, not about the machinery

needs on an actual project, but more about maintaining a

machinery fleet in between projects.

Management of the fleet

When it comes to fleet management, pipeline construction

equipment can be divided into three major categories:

)

A1: Essential equipment, needs to owned.

)

A2: Necessary equipment, can be owned, (some)

alternatives available.

)

A3: Needed equipment, no need to own, widely

available.

Without going into too much detail, category A1

equipment can be defined as specialty equipment like

welding systems and HDD equipment, and can even be

translated in soft skills like project management. It covers

all the items a pipeline construction company specialises

in.

Category A3 is easiest explained as earthmoving

equipment; machines that are widely available, even when

in more remote locations.

Finally, category A2 is reason for most discussions; the

specialised pipeline construction equipment covers the

likes of pipelayers, welding tractors, and pipe bending

machines. These are machines that are always necessary

but have a fairly limited availability, even on a global scale.

Due to this limited availability, construction companies

generally prefer to own this specialised machinery so they

have direct access at all times. Therefore, most pipeline

construction companies choose to have a basic equipment

fleet with a limited quantity of machines – largely

machinery that is suitable for most common diameters. This

gives the company the flexibility to mobilise quickly and

build smaller projects, without having the financial burden

of a large number of machines.

Fortunately, most pipeline construction equipment

has a long, useful lifespan. As opposed to earthmoving

equipment, pipelayers, welding tractors and pipe bending

machines stand idle for most of their time on a project. As

project diameters may vary, it is also possible that machines

cannot be used because the pipe diameter is either too

big or too small, resulting in longer periods of standstill

in between projects. After a number of years, even with

sufficient projects, this can result in machines with

relatively low working hours.

The very first Liebherr pipelayer RL422-1001

manufactured in 1995 currently has 13 500 working hours,

which means an average of approximately 2.5 working

hours per day (based on 45 working weeks per year, five

working days per week, for 25 years). This low occupation

does result in a high residual value of pipeline construction

machinery in general.

Another reason for owning pipeline construction

equipment is that, in some cases, it is mandatory to have

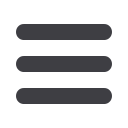

Figure 2.

A full, large diameter welding spread.

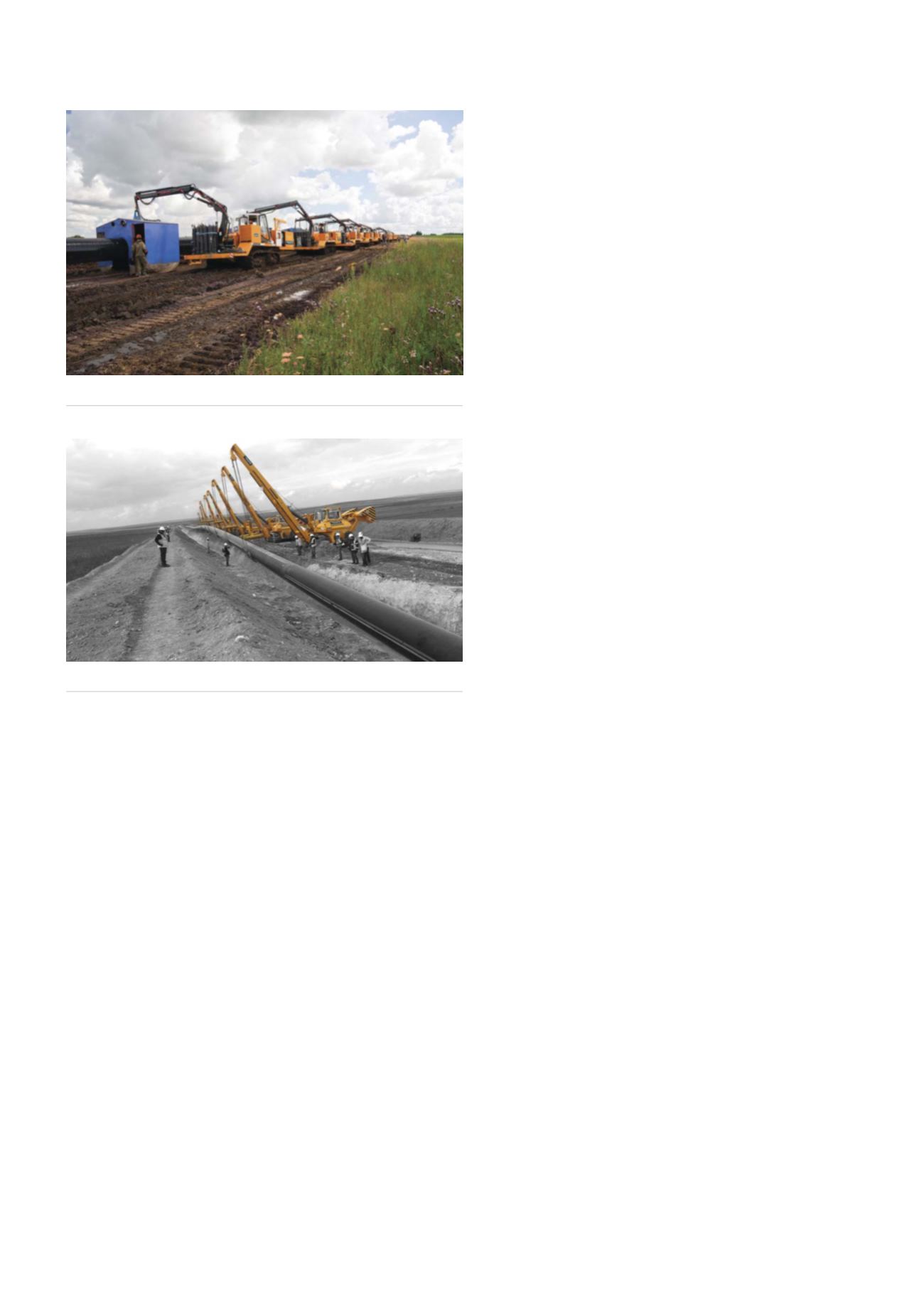

Figure 3.

Eight RL64 in action on a 48 in. jobsite in Turkey.

34

World Pipelines

/

MARCH 2020