March

2017

HYDROCARBON

ENGINEERING

18

argument lost its potency. The

restrictions were seen mainly as

creating barriers to efficient trade. In

particular, LTOs from landlocked areas

had a transport disadvantage, and

they were sold at low prices to

refineries along transport routes. This

was a chief cause of the widening

Brent-WTI crude price differential

shown in Figure 1. US market prices

diverged from global prices. The

refineries with access to the

inexpensive crudes increased

utilisation, and increased their

product sales and exports.

Figure 8 compares the trend in US

crude exports with crude imports. In

2016, both imports and exports rose.

However, imports rose more than

exports, so net crude imports

increased by over 1 million bpd. Easing

the export restrictions did cause an increase in

exports, but it did not cause a decrease in

refinery supplies of crude. The opposite appears

to be happening.

How do US refineries receive

crude oil?

The US has the largest refining industry in the

world, spread from coast to coast and including

two non-contiguous states: Alaska and Hawaii.

Delivering crude to these refineries is a massive

logistical exercise. The shale boom added

another layer of complexity, since many of the

new shale plays were not connected to existing

oil transport infrastructure. This created a need

for additional transport infrastructure and the

use of alternative modes. How do US refineries

receive crude oil, and how has this changed?

The key role of pipelines

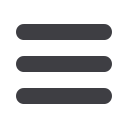

As Figure 9 demonstrates, pipelines are the

dominant transport mode used to deliver crude

to US refineries. In the early 1980s, pipelines

delivered nearly two-thirds of crude receipts.

This slowly declined during the years from the

late 1980s until 2005, when pipeline deliveries

fell to around 48%. After 2005, however, a

resurgence in pipeline deliveries began, and in

2015, pipelines were responsible for nearly 61% of

crude deliveries. In 2015, US refineries received

16.452 million bpd of crude oil, 10.026 million bpd

of which was delivered by pipeline.

Transport modes for foreign crudes

and domestic crudes

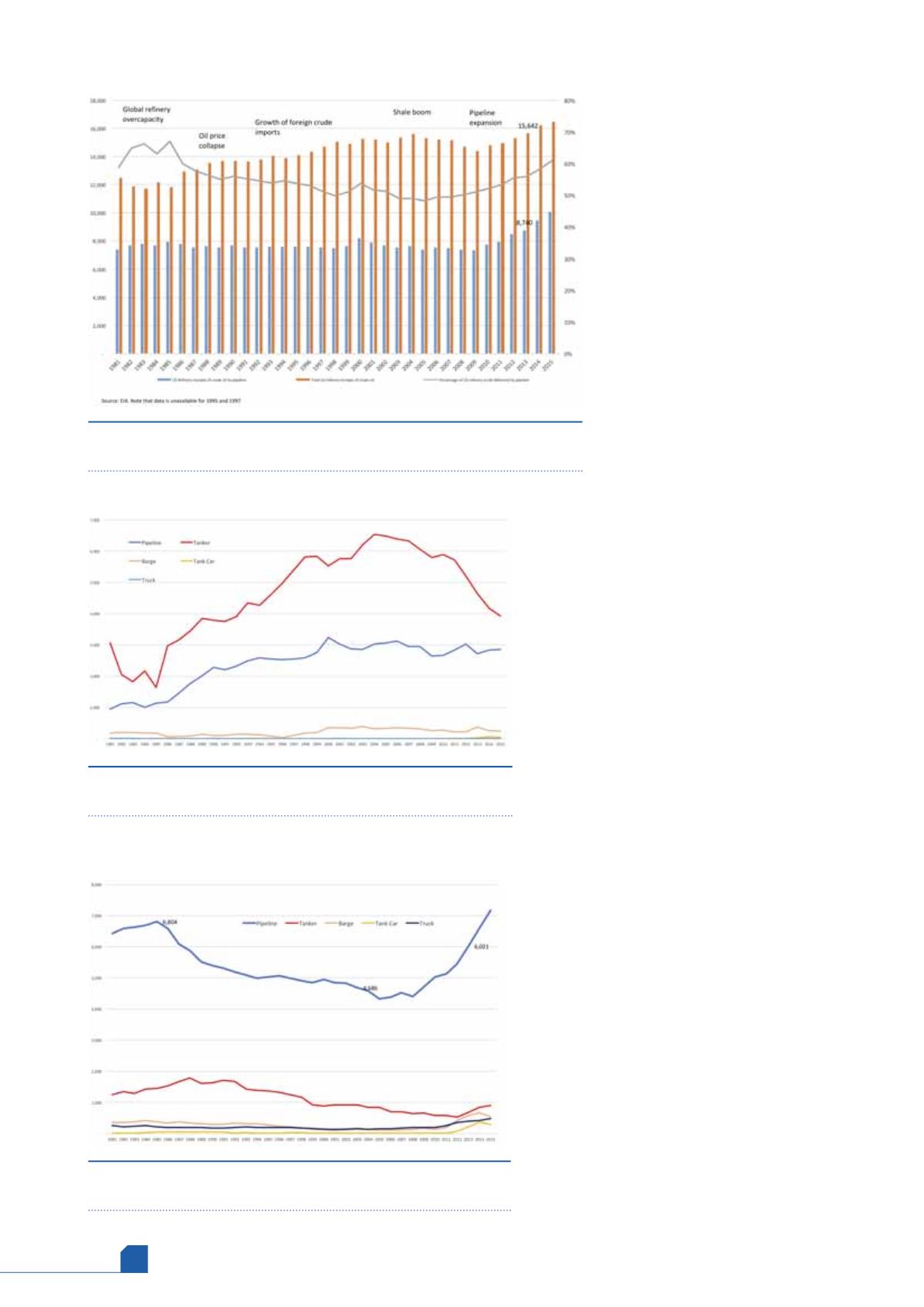

The reason for the changing percentage carried

by pipelines becomes clear if domestic crude is

separated from foreign crude, as Figures 10 and 11

illustrate.

Figure 9.

The key role of pipelines in delivery crude to US refineries

('000 bpd and % of total).

Figure 10.

US refinery receipts of foreign crude by transport

mode ('000 bpd).

Figure 11.

US refinery receipts of domestic crude by transport

mode ('000 bpd).